Similar to gold, silver coins have been used as a form of currency for centuries. Prior to 1965, most US coins contained 90% silver. As the price of silver began increasing, less expensive metals such as nickel and copper were used in place of silver..

Silver has played an essential role in much of the world’s development. However, It’s use as a conductor of electricity has been the most beneficial use by far. Silver has been an integral part of every major component in the technology . Without silver, you wouldn’t be reading this right now. In fact without silver, its unlikely that phones and computers would exist.

It the 1960s, a company called Eastman Kodak improved the development of film using silver gelatin. It was a significant breakthrough that transformed the development of film in a monumental way. Silver demand increased significantly as the industry grew. This was the first time silver was employed on a large basis. Silver was no longer merely a precious metal; it was also a precious commodity.

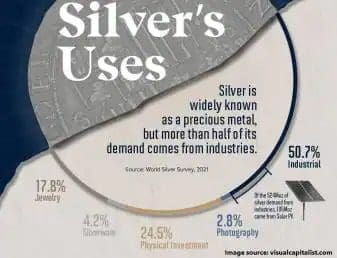

Today, the uses for silver are endless. It’s used for everything from medical disinfectants to electronics, from solar panels to electric car batteries, and everything in between. As technology continues to advance, the need for silver will continue to grow. In fact its for this reason that many analysts believe there is much more growth potential in silver, than in gold.

Although there are several ways to invest in silver, It’s almost always best to purchase physical silver. Nevertheless, there are several other ways to invest in silver. In this article, we’ll go over some of the other ways along with the benefits and drawbacks.

SILVER COINS

1 -Silver coins

Physical silver is classified into three types: silver coins, silver bars, and silver rounds (also known as bullion). Silver coins are the most widely collected silver throughout the world. The coins Purity plays a crucial role when purchasing silver coins.

Silver coins with a purity of .999 and .9999 are among the purest and safest silver coins. Many countries mint coins in .925 silver, otherwise known as sterling silver which is just over 90% pure silver. It wasn’t that long ago that silver coins simply featured various designs on both sides of a silver blank costing just a few bucks over spot price.

With advancements in Technology, numerous mints create some of the most stunning awe-inspiring coins considered works of art. There are many silver coins weighing just a few ounces that sell for thousands of dollars. These are coins featuring mesmerizing 3D designs combined with rare earth metals and embellished with precious gems. Not really for a beginner.

Prior to 1965, nearly every coin in the United States was 90% silver (with the exception of the nickel and penny). Today, they’re referred to as junk silver. The term has no relevance to the condition of the coin, it’s merely a nickname that has stuck over the years.

SILVER ROUNDS

2- Silver rounds

If you want the best bang for your buck, then silver rounds and bars are the way to go. Although some silver rounds may look identical to silver coins, there are significant differences. Only Governments and Sovereign Nations can issue currency in the form of coins. Coins also have a face value and a date.

Rounds are privately minted and don’t have a face value and cannot be used as currency. Their value is based solely on the precious metal content itself. In order for silver rounds to be considered investment grade, they must be stamped with the weight, purity, and metal content.

If you shop around, you can find some nice rounds and bars for as little as three or four dollars over spot price. It wasn’t that long ago that you could purchase brand new silver eagles for just as much. Those days are long gone. At the time of this writing, November 2021, you can expect to pay $10 over spot for a silver eagle and as much as $5 to $6 above spot for a Canadian maple leaf

SILVER BARS

3- Silver bars

Just like rounds, slver bars are also one of the least expensive ways to purchase silver. Their uniform size allows them to be easily stacked and stored. Silver bars are both pressed and poured (cast bars). They come in a variety of shapes and sizes. They range from 1 gram to as high as 1000 ounces. .

When purchasing silver bars, there are certain things to consider. Quantity is very important especially when purchasing large sums. In such cases, it’s important to have a well-thought-out plan. For instance, if you’re looking at just a few thousand dollars’ worth of silver, that can fit in an ordinary lunch box.

If you’re looking to purchase $100,000 worth of silver, you would need 3 average-sized suitcases, and they would weigh roughly 200 pounds (at the current spot price). Storage, security, and transport are just a few things that should be considered ahead of time.

EQUITIES (ETPs)

4- Silver equities

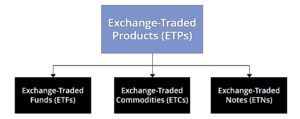

A fourth option for purchasing silver is to invest in exchange-traded products, referred to as “ETPs”s. These are securities whose performance is determined by an underlying asset, Index Fund, or sector. Most typically fall under one of three categories

ETN: (exchange-traded notes) are securities that track a particular index. They’re structured similarly to bonds, but instead of paying interest, the price fluctuates, much like a stock on an exchange.

ETF :(exchange traded funds) have grown in popularity and are the most widely held. The Sprott Physical Silver Trust (PSLV) is among the largest ETF. Before a company is allowed to join, it must meet and adhere to a strict set of standards.

ETC: (Exchange-Traded Commodity). There are two variations with significant differences. The first is a physical-backed commodity, while the second is a synthetic commodity. The synthetic are highly speculative and carry a significant amount of risk. The Synthetic are pegged to swap arrangements that simulate market returns. On the other hand, physical backed ETC’s own a portion of the underlying security, in this case, silver.

MINING STOCKS

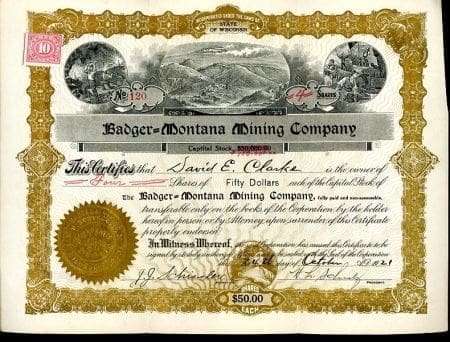

5- Mining stocks

Purchasing stock in mining companies is another way to invest in silver. Its worth noting that mining stocks are among the riskiest to invest in. It’s important to understand the different types of mining stocks. For example there are only a handful of large cap mining companies, also referred to as seniors. Although still considered risky, these are typically the safest mining stocks. These are multinational billion dollar companies that own mines throughout the world. They have a record of producing significant profit and large amounts of gold and silver bullion for decades.. Newmont and Wheaton are among the largest.

Next we have the junior miners. These are considered are more risky than the seniors. Nevertheless, some of the most successful mining companies over the last decade were juniors mining companies including: Endeavor, Coeur, Hecla, Harmony and Fortuna Silver Mines .

So why are they so risky?

Mining operations are some of the most tedious and dangerous endeavors in the world. From the time a deposit is discovered, to the time the mining operation begins takes well over a decade, sometimes as long as 15 years. That takes a large amount of capital tied up for a significant amount of time. Tens of millions of dollars are spent often before a single ounce of silver is produced . When you consider the costs:

- Machinery to traverse difficult Terrain.

- Employing hundreds / thousands of workers.

- Feasibility studies

- Fuel/energy consumption.

- Milling process..

- Mine & town Infrastructure

- Work Permits /surveyors.

(And those are just a few..)

Geopolitics plays a big part and poses many challenges for mining companies. Many of the largest precious metal deposits are in third-world countries with unstable governments. This often causes problems throughout the lifetime of a mining operation. In 2021, a successful mining company from the U.K called Hochschild had two of their largest producing mines in Peru (Immaculada and Pallencata) shut down after a change in government denied renewal of their mining permits. This caused their stock to plummet over 25% in a few hours and lost half of their market share over the next few days. Those are just a few of the challenges Junior miners face.

Finally, there are exploration and discovery companies. These mining stocks carry the highest risk of all precious metal stocks. There are thousands of exploration stocks on several exchanges, with well over 1,000 just on the Toronto Stock Exchange. Although it’s not often, when these companies do discover a valuable deposit feasible for an operation to begin, the market share does rise exponentially. In many cases, they’ll increase by 1000% “10-baggers” in a short time. Keep in mind that there are just a handful of companies out of thousands that achieve these types of returns.

We can’t stress it enough, physical silver is by far the safest way to invest in silver. Regardless of how much you may be looking to invest, the best piece of advice is always seek advice from a a professional financial advisor.

This Article Was Written Solely For Informational Purposes. ABS Bullion Does Not Endorse Any Of The Aforementioned Companies. Before Investing, Always Seek Advice From A Finacial expert.